Market Data and Values for Wireless Infrastructure from the Data We’ve Gathered

If you are a property owner considering monetizing your wireless lease rents or an institutional investor trying to determine the value of lease/easement cash flows under wireless infrastructure, information on street-level market pricing is not readily available to you. Our Market Data section provides current, real-time insight into the market that could be of use to you as you weigh your options or undertake due diligence.

The various firms that offer to purchase wireless leases from property owners are motivated to do so as cheaply as possible. Having information on current lease offer trends is imperative, and TCA is the only firm to publish them. Knowing how much an asset is worth in today’s market is a must for a seller.

Full Year 2023 Update – Valuations and Historical Prices for Wireless Leases and Towers

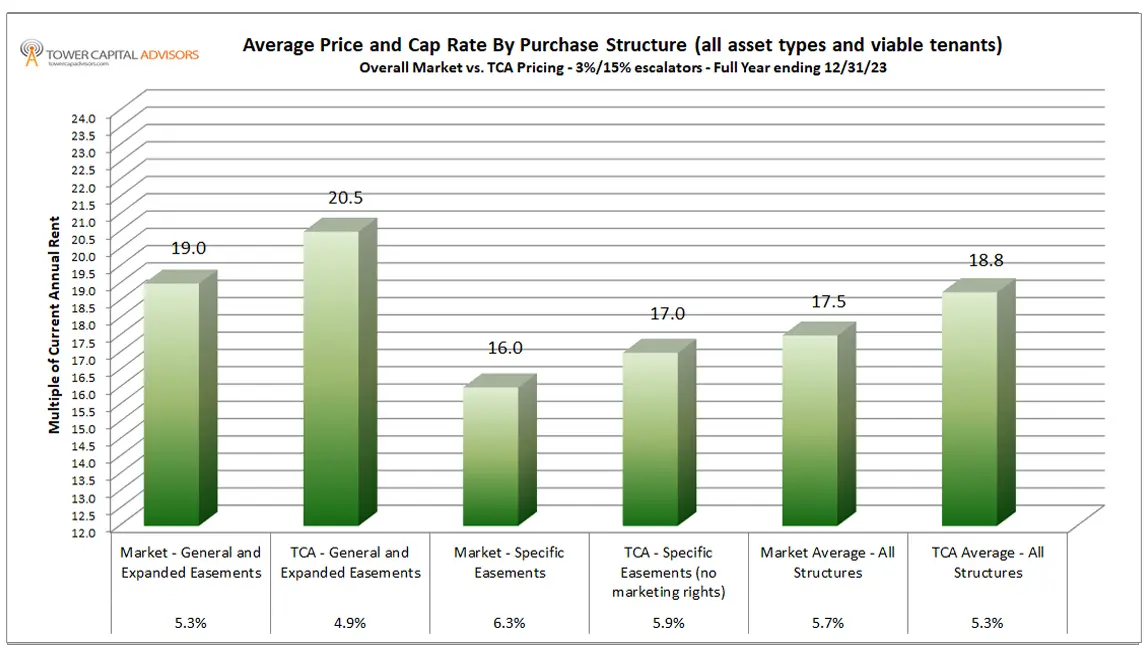

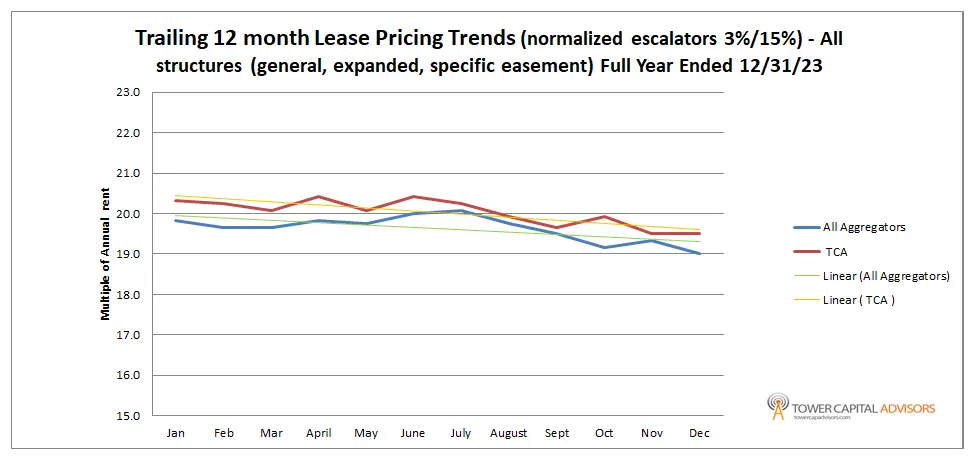

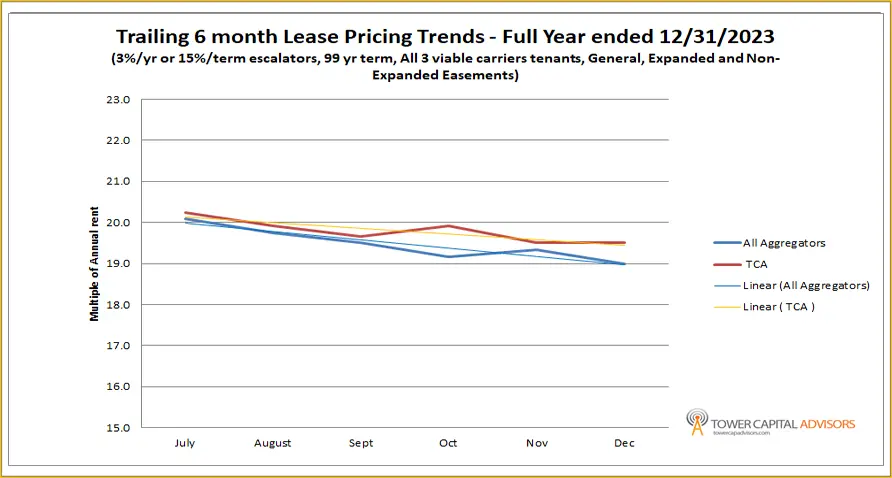

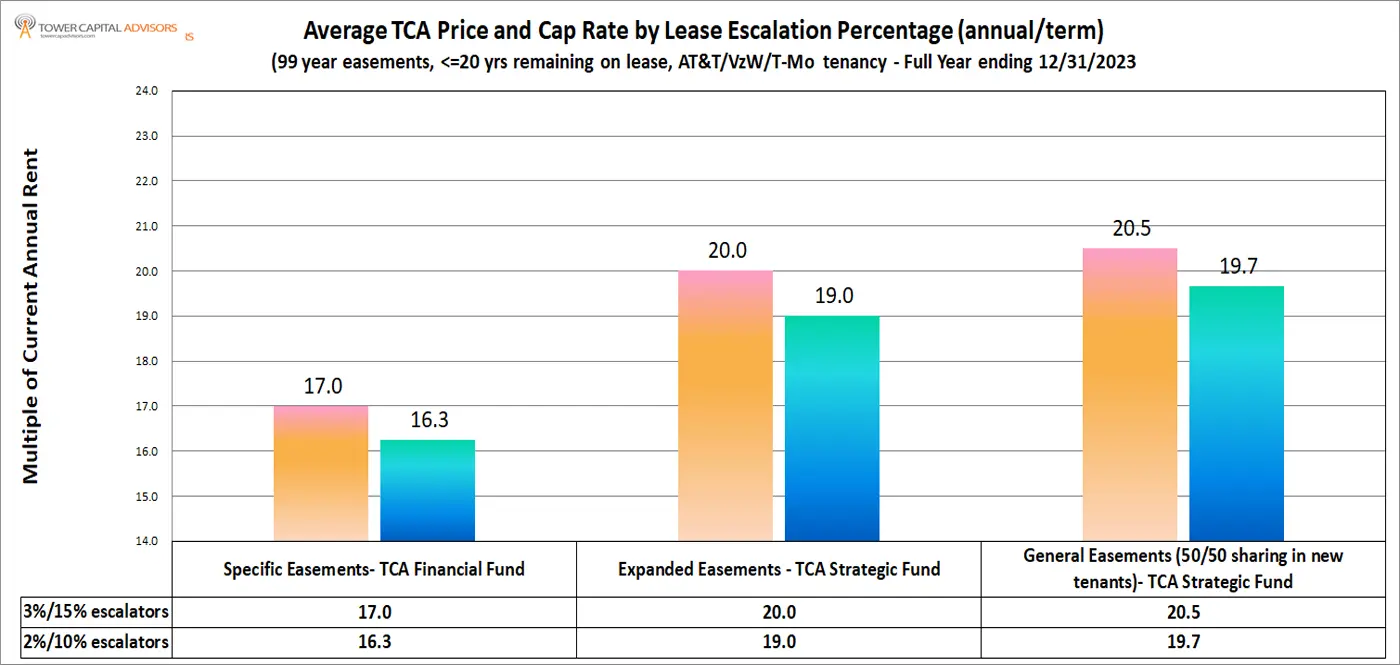

TCA analysts track (confidentially) the offers for wireless leases and tower purchases made by aggregation firms to property owners that contact us, subsequent offers for the same assets from TCA and the overall trend of value for the leases in the industry. Based on a review of the full year 2023 data, we have distilled the following information and trends:

Note: Averages are calculated by TCA from discussions with both site / tower owners and industry personnel. They are opinion. Unless otherwise noted, most of TCA’s statistics are normalized for perpetual purchase terms and 3% per year (or 15% per term) escalations, as they are the most common in the industry. Lower escalators would result in lower offer prices. Higher annual escalators could result in higher than average offer prices. Data also nets out short-term expiration purchase offers (offers for leases with 5 or fewer remaining years in the lease terms provide a pro forma rent hike opportunity for the buyer).

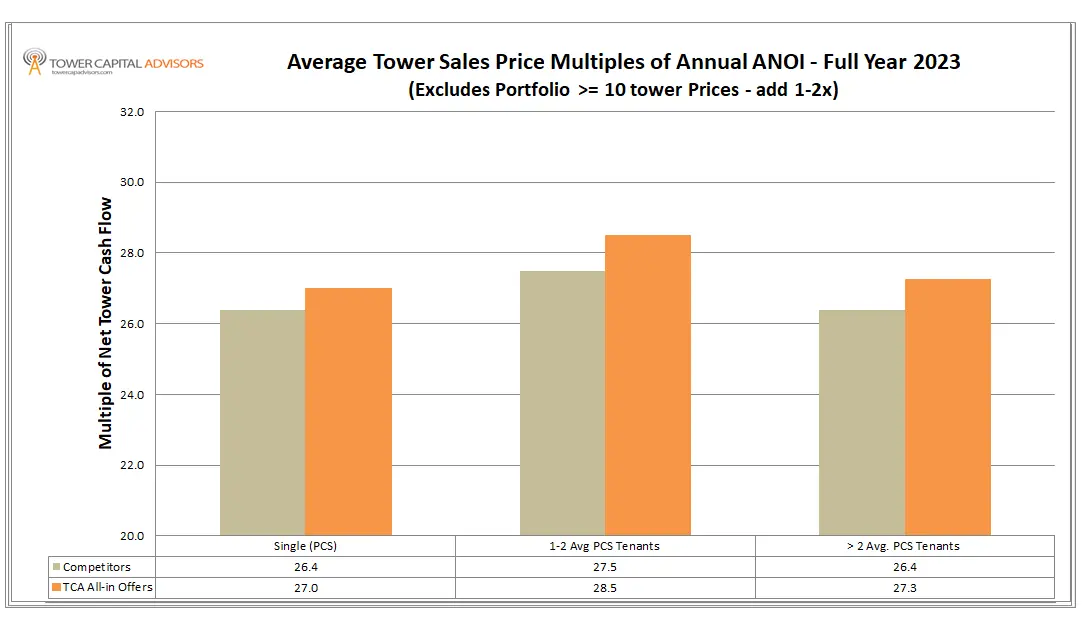

TCA Tower Acquisitions and Valuation Data

Tower Capital Advisors currently performs a regular service as part of our scope of work as a national partner of one of the 3 major carriers that requires us to analyze, structure, evaluate and price numerous tower and rooftop leases being acquired for our own account or for AT&T directly. Our own acquisitions are consummated with one of two well capitalized funds or on behalf of our carrier partner. If you own one or more cell towers with cellular tenants, we believe our expertise in maximizing the value of these assets would benefit any current or future seller of wireless infrastructure.

In addition to suggesting that you view our Recent Transactions page (updated quarterly), below we have provided data from our 2023 tower acquisitions that we hope you find useful:

TCA Commentary – 2023 year in Review – A resilient (but softening) market finally feels the effects of inflation:

With the cost of debt financing rising dramatically over the last 24 months, we are finally seeing some softening in valuations and offer prices. Most notably, tower prices were the first to withdraw from record prices that, at times, exceeded 30x annual ANOI in recent years. Lease-only/easement prices took longer to pull back and more noticably saw a reduction in the number of buyers able to sustain historical highs. Peaks of 21x for leases with the big 3 carriers and 3% or higher escalations are still available, but from fewer players. The equivalent cap rates for these transactions were, on average, just under 5% for leases and in the high-3% to low-4% for towers.

As stated in our last update, uncertainty in the capital markets and the COVID-19 pandemic’s effect on commercial property values combined to increase buyers interest in and prices for this asset class and stimulated wireless lease landlords to monetize and tower owners to sell. Few other commercial property types were doing well (think office and apartment buildings, retail, shopping centers, etc.) and, with investment-grade tenant credit counterparties like AT&T, T-Mobile and Verizon paying the rents – new capital entered the market in record amounts.

We noted many of the more seasoned portfolios exhibiting discipline in the latter half of 2023 with a focus on fewer, but more profitable transactions. A select few portfolio buyers did not. Our opinion is that those that did not are working on market share strategy (a land-grab) that may dissuade newer capital and push the less well capitalized funds out in anticipation of a downturn. We saw this exact situation in 2009-2011 – and it inevitably results in very few competitors and much lower prices. Those with high overhead that cannot survive the onslaught of low returns leave and the land-grabbers then more than making up for their past expensive acquisitions by being able to feed on easier, less expensive prey.

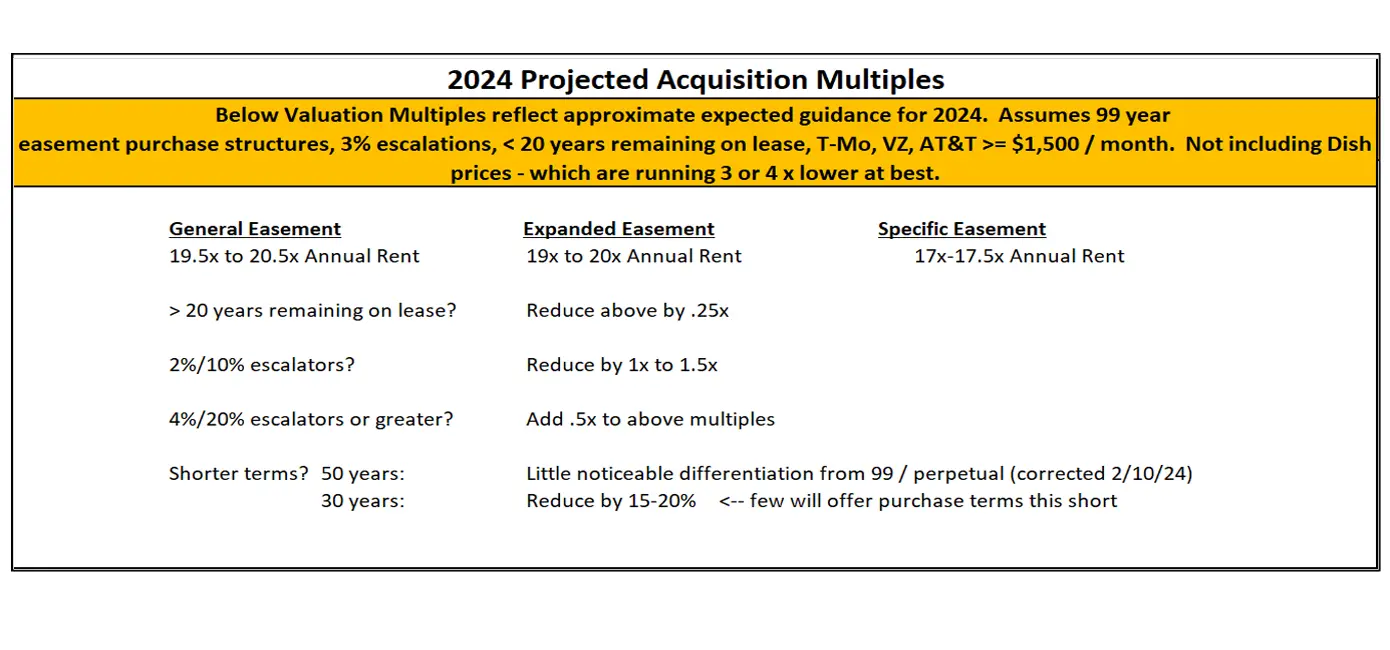

Market Outlook for 2024 for Wireless Leases and Cell Towers

Despite employers demanding their employees actually come to work in the office more frequently, office vacancy rates are at record highs. Combined with looming bullet maturities on their debt, this does not bode well for cap rates associated with commercial office real estate in 2024 and wireless infrastructure will continue to be an attractive, REIT qualified alternative.

What does the future hold for the value of wireless leases and tower assets?

Here are some of our thoughts:

As it relates to lease/easement purchases - more Seller's will want to come to market but will likely be stymied by their lenders - who will not want to release collateral wtihout taking the proceeds from the sale. Commercial defaults are on the rise and the lack of affordable refinance alternatives are going to make obtaining lender consent to sell easements more difficult in the coming year. While this happened in 2009-2011, refinancing rolled many unsecured positions taken by wireless infrastructure aggregators into first positions, allowing them to acquire deals without SNDA's. We do not see that happening this time and the ability to buy a lease with an easement with the consent of the lender is going to be problematic. Few buyers should want to acquire these revenue streams without the buy-in of the lender of record on the property.

As it relates to tower values – and while the 'fantasy' of lease-up will still pay more than the reality of existing tenant revenue, the number of viable investment-grade carrier tenants is limited to 3 with Dish having fallen out of favor dramatically over the last 12 months. Limited lease up opportunities to 3 tier I tenants, smaller spend budgets for amendment and new build activity for these same parties combined with heavier debt loads on aggregator portolios has already resulted in lower multiples being offered for tower purchases - and we believe this pressure will continue in 2024.

Pricing Projections: In the near term (1-2 years), and based on our opinion only, lease values will drop a little further from their 2023 levels and tower multiples will likely stablize in the mid-to-upper 20's. Factors effecting value are:

Inflation, and the resultant increase in the cost of borrowing for the buyers of these assets is a likely result of undisciplined monetary and spending policy. With resultant increases in the cost of funds of the buyers of these assets, will come decreases in prices to the sellers.

Commercial real estate businesses and values will be negatively affected. Properties reliant on rent from retail establishments, offices and apartment buildings will likely see significant reductions in their cash flow. This will result in defaults and reduced debt-service-coverage ratios that may mean banks that hold mortgages on commercial properties that have cellular revenue will be less likely to attorn (consent) to the sale of those assets. Such consent is a requirement of 97% of all closed lease sales and by all buyers in the space.

The number of buyers may eventually be reduced as firms that are not capable of competing exit the business or fail. Less competition will mean lower prices. This happened in 2008-2009 and will happen again, especially with new, less experienced capital entering the market.

Our recommendation is that landlords and tower owners consider monetizing these assets while the market continues to be reasonably hot. Further, if a property owner is also looking to sell the underlying property / business / building that wireless infrastructure is on, they should sell the wireless leases/tower first and THEN look to divest the actual property. This is because the cap rates on wireless leases will continue to be lower (meaning higher prices) than they are on the underlying property.

Other Valuation Considerations

Buyer Focus is on Possible Upside via expansion of the size of the easement being purchased and shorter remaining terms on the leases:

The most significant (positive) differentiation in pricing for both rooftop and tower ground leases can be seen in offers structured with upside potential (real or perceived) for the buyer. The highest prices in the market today for lease/easements are available to sellers if;

Their lease and all renewals expire inside of 20 years,

Their escalations are at 3% per year or 15% every 5 years or higher,

They are willing to accept a general or expanded easement purchase structure.

The first characteristic (nearer term expiration) provides an opportunity for the buyer to increase rents. Note that this is in spite of the fact that in more than 50% of the cases we have seen in the last 20 years, rents are REDUCED at lease expiration.

The second characteristic that optimizes a sellers price is the escalation provision. For a given price, yields to the buyer are, of course, lower if the escalation in the lease being acquired is low and that is reflected in a lower price.

The third opportunity for buyer upside comes from expanding their easement area. The highest offer prices for tower ground leases and rooftop leases are coming with general and/or expanded easement areas that hope to capture either new tenant or expansion needs by existing tenants down the road. Offers to share with the seller in this potential future upside tend to only be structured for new tenants and range from 50/50 to 70/30 in the sellers favor.

Despite this uptick in value and price, initial offers made by the firms that use outbound calling and mail to contact landlords with wireless leases on their property continue to lag the pricing available from firms without marketing staff.

We recommend sellers who have been ‘cold-called’ by prospective buyers of their leases reach out to TCA to determine both the pedigree of the buyer (are they brokers or actual buyers?) and whether the price being offered represents the true value of their asset. Tower Capital does not make outbound calls to try and buy leases or towers. In addition to working with AT&T at their request to acquire their towers or leases, TCA responds to inbound inquiries only.

While landlords to the carriers and tower companies are enjoying this recent sizable uptick in prices based on a buyers potential upside potential, do not expect such offers to be simply crafted. Many require general telecom easements across the entire property allowing the buyer to ‘market’ the property for additional tenants while offering sharing arrangements back to the landlord in any new rent ‘found’ (or more often fortuitously happened upon). The probability of finding additional tenants for a site remains low as there are both fewer viable ones (AT&T, T-Mobile and Verizon) and the tenants themselves have a strong preference as to who is managing a property with most preferring to avoid properties managed by tower companies (particularly public ones) altogether. We also continue to believe that strategic acquisitions of rooftop leases that offer seller’s sharing in new tenant revenue can be conflicted with the buyers interest in locating new tenants on their own towers rather than on a rooftop that requires a split with the property owner.

Additional Information for Wireless Landlords and Prospective Sellers

Tower Company offers for their own ground leases: The public tower companies have demonstrated that they are quite interested in protecting their tower assets and in defending against 3rd party acquisitions of ground leases under their towers. As you can see from the above chart, TCA has managed to stay ahead of most of their initial offers for their own leases as they are made through their vendors who must be compensated. We continue to recommend that landlords to tower companies who are approached by their tenants to extend, amend or sell their current leases seek professional advice before doing or signing anything. TCA offers a much simpler closing process, documentation and shorter closing time (absent a need to get the consent of a mortgage holder, closing time should be less than 45 days vs. times 3 to 5 times longer to close with some of the public tower companies). Shorter closing time means lower legal costs for the seller.

Near-term expiring tower ground lease pricing: While offer prices for ground leases under cell towers have seen a recent modest increase in price, offers for ground leases under towers with multiple tenants whose final expiration is within a 1-10 year time frame have reached extraordinary levels. TCA continues to recommend that property owners with leases whose final expiration is coming due in the next few years not sign extension amendments or lump sum offers without consulting with an expert. We provide pro bono estimates of value for tower ground leases meeting this criteria to all property owners.

Who Is a Buyer and who Is a Broker?

Here are some of our thoughts:

The influx of formerly employed sales staff from now departed acquisition firms into the market has reached astounding proportions. The number of ‘brokers’ or intermediaries operating in the market offering to either advise sellers for a fee or seeking to broker their transactions to one of the few actual portfolio buyers for a fee is now well into the double digits. We have seen a number of these brokers attempting to arbitrage huge profits at the expense of the seller, so caution when dealing with them is advised. Note TCA does not charge private property owners for our advice, regardless of whether we do a transaction with the seller or not.

In 2023, we continued to see a number new broker platforms emerge in the market. Taking an offer from a broker vs. a capitalized firm may mean your asset gets shopped to many potential buyers in exchange for a profit for the broker. Signing an LOI with a broker vs. directly with a well capitalized fund means you are leaving an undisclosed amount of money on the table.

TCA cautions prospective sellers that offers by buyers to ‘share’ in rent increases above ‘scheduled rent’ at lease expiration or renewal should be viewed with suspicion or ignored when evaluating purchase price and structure, especially if there is a Right of First Refusal in your lease. Those transactions are highly likely to be favorably amended for the tenant by the buyer post closing.