Discover Real-Time Updates from Our Market Data Results

Extension amendments and ROFR clauses: The sale of most of the towers previously owned by AT&T, T-Mobile and Verizon to the large public strategic tower companies created a furious ‘amendment and extension’ initiative by the tower companies that continues today. This initiative centers on an attempt to lock up the rent on leases that would expire in the near future and remove the possibility of the property owner negotiating a higher rent at lease expiration. Just as importantly, if not more so, the tower owner / tenant is very interested in obtaining Right of First Refusal (ROFR) clauses in leases that did not previously have them. This is done to prevent other firms from purchasing the leases and, in turn, looking to increase their rents. We strongly suggest that sellers contact TCA if they are being pressed to sign extensions or amendments with ANY tenant - especially if they are looking to insert a Right of First Refusal.

Having a ROFR in a lease with a tenant reduces the value of your lease because it also reduces the number of firms willing to make an offer to purchase it – leaving mostly the brokers or buyers that are connected with your tenant to make offers. While ROFR’s in carrier leases have historically been less of a concern as carriers often do not have the capital to exercise their ROFR rights, that is changing.

Offers to share in the rent from additional tenants are usually part of the offered structure, with 50/50 having become a common sharing arrangement. While many sellers ARE interested in having additional revenue put on their property that they can benefit from, TCA cautions sellers that any sale structured with the promise of additional rent down the road needs to be carefully reviewed. Promises to bring a tenant to a tower the buyer doesn't own are worthless (and in our opinion, unethical).

On the topic of Rights of First Refusals, Rental Stream Offer Rights and Consents:

T-Mobile Consent Requirements – If a property owner ever wants to monetize their lease either for additional working capital or to de-risk the possibility of losing the revenue in any de-commissioning, etc., due to mergers among the carriers, we strongly recommend you find a way to eliminate any ‘consent to assign’ or ‘consent to sell’ from a T-Mobile lease. Removing it is NOT possible once the lease is established (why would they?), but if you are negotiating a new T-Mobile lease, it would very much benefit you to strike any such language. While T-Mobile has no history of purchasing their own leases back, our understanding is that they will only consent to a sale if the buyer gives them a sizable reduction in their rent and agrees to make it difficult to impossible for them to re-sell or re-finance the lease as part of their own portfolios. This results in much lower prices or, worse yet, a complete inability of the better-capitalized buyers to make an offer on your lease at all.

AT&T Tower and Right of First Refusal buy-back initiative – In 2018, AT&T quietly announced the availability of a significant pool of capital to proactively purchase their own rooftop and ground leases as well as towers from their landlords interested in selling or monetizing. This program was put in place to prevent both the landlords and AT&T from being taken advantage of by unscrupulous buyers and has continued to this day. TCA manages this process for them performing valuation analyses at their request.

TCA is a national partner of AT&T. We honestly explain the pros and cons of monetizing a lease or selling a tower and can provide a quote directly from AT&T if a seller is interested in selling either. Given the current pricing available in the market, we are definitively pro- ‘sell’.

As it relates to Verizon Rights of First Refusal clauses: Watch for a forthcoming position paper by Tower Capital Advisors on how to deal wtih Rights of First Refusals in your lease.

Current Cap Rate Equivalents – 2023 Full Year Update

Tower Capital Advisors' offers have remained ahead of most all buyers for both specific easement purchase structures as well as expanded easement purchase structures. Our financial aggregator competitors continue to attempt to come in low and slowly rise to meet competitive pressure. Our strategic competitors continue to offer structures that are involved, overbearing and difficult to document and close. We offer the same structures (and associated higher pricing) with a much shorter timeline for funding and less complex documentation.

Sellers should be very wary of offers to purchase general or expanded easements on their property that attempt to capture new tenant revenue and promise to ‘market’ the site to the carriers. Carriers put sites where they need them, not where they want them, and few of the buyers in the space have any actual initiatives or personnel dedicated to marketing at all. Their goal is to capture a piece of unforeseen rent without having done anything to deserve it. Finally, note that no one can ‘bring new tenants’ to a tower they don’t own, and few can bring on to a rooftop. Ask for statistics and references from any buyer offering to bring new tenants to you, and when you do not get any, you are likely to agree.

TCA’s best-foot-forward offers still surpass the initial offers of all of the aggregation firms. TCA does not ‘start low’ and works its way up to match competitive bids. We do not believe that property owners looking to sell their leases should want to deal with buyers that initially try and take advantage of them and, in the face of competition, increase their offers after the fact. TCA has been able to keep ahead of the market with our offer prices after having entered into a facility arrangement with our institutional funding partner. TCA is not a ‘broker’, and we close directly onto the balance sheet of our funding partner. We would be pleased to arrange a call explaining the process of selling a lease with our closing and legal department at your convenience.

TCA’s objective in providing you and the public with this data is that we hope you will allow us to bid on your site when you choose to sell.

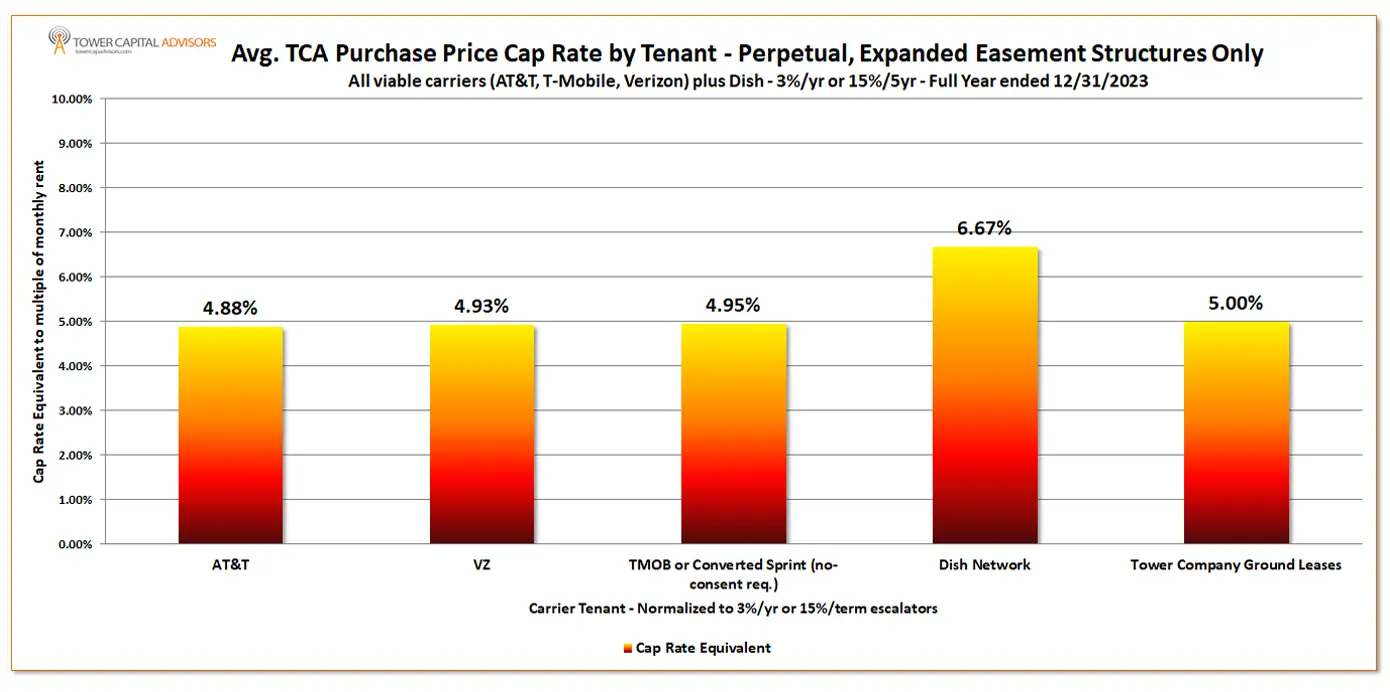

2023 Full Year Update: Average Cap Rates offered by TCA for Wireless Leases:

Note: While TCA continues to provide carrier-level statistics on cap rates, there is no real significant differentiation between the three remaining investment-grade carrier tenants – the differences shown above between AT&T, T-Mobile and Verizon are likely based on sample size and TCA’s relationship with AT&T (provides superior pricing). Dish, being newer to the market, is priced less aggressively.

About Tower Capital Advisors – Services and Acquisitions

TCA is an institutional advisory firm, an acquirer of wireless leases and cell towers for two financial institutions and a national partner of AT&T that manages AT&T’s own acquisitions of lease and tower assets. While we charge institutions for our services (we have been a buy-side advisor on multiple portfolio purchases totaling more than $1 billion in the last 4 years), we do not charge individuals, small businesses, municipalities or religious entities for our advice. We also publish annual valuation statistics for wireless leases and towers to benefit landlords who are interested in monetizing their assets and need a place to go to assess value.

With respect to those landlords that are interested in lease monetization or physical tower asset sales, we provide offers from one or both of our funds (as well as from AT&T if they are a tenant on any of the infrastructure). We have no sales personnel calling to try and buy leases or towers below market value and no ‘call center’ pestering landlords. Our principle was one of the founders of what has become the industry of buying cell tower and rooftop wireless leases and easements and have been acquiring these assets for 18 years. Finally, we have learned that a good business doesn’t have to be based on outbound ‘selling’. It can be built on the provision of truthful, useful information and some of the best pricing in the sector.

TCA Offer Prices

TCA offers remain ahead of initial offers from other aggregation firms and have an average of approximately 20 x annual rent (normalized for 3% escalators and 99-year purchase terms).

Ours (and others) prices for 3 of the major tenants (AT&T, Verizon, T-Mobile) had remained somewhat undifferentiated other than for T-Mobile leases with ‘consent to sell’ clauses. ROFR's and consent requirements require a buyer to 'pay homage' to the tenant in the form of amendments, extensions, rent reductions or up front fees - and thus reduce offer prices to the seller.

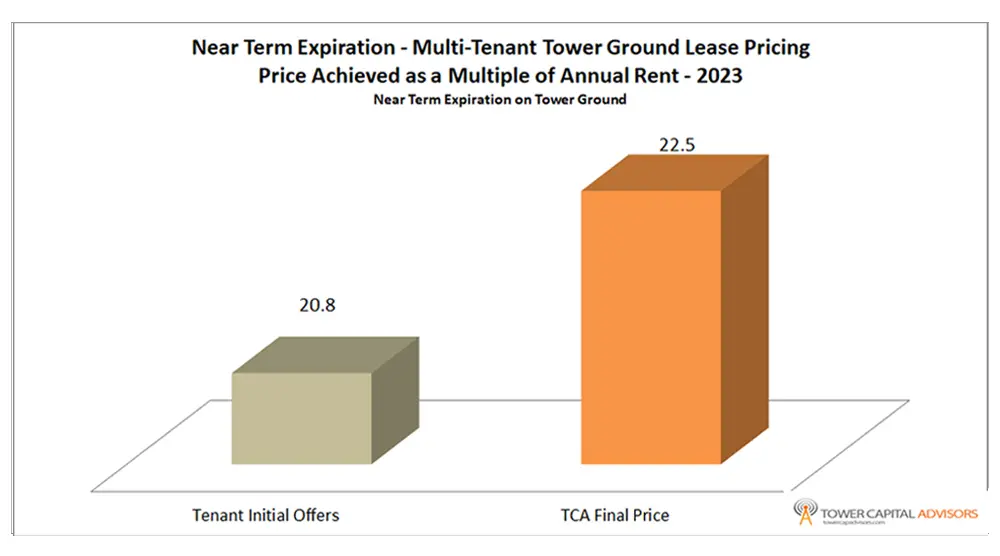

Near-Term Lease Expiration Purchases; buyers are very interested in acquiring tower ground leases (especially those towers with multiple tenants on them) and, other than typically offering higher prices, Tower Capital Advisors is no different.

We cannot stress strongly enough that a landlord to a tower company or carrier should NOT extend a lease that is about to expire without discussing it with a professional. The initiatives of the tower companies to extend leases on towers with multiple tenants are the most important to them – and there are buyers in the market that will absolutely pay MORE, not less, when a lease is about to expire. You should understand that value before signing any extension amendment with your tenant!

If you have a cell tower lease on your property with all of the optional renewals ending in the next 10 years, and whose lease does NOT contain a Right of First Refusal, contact us today.

Expected Continuing Trends and TCA’s Advice

1. As noted above, with the acquisition of Verizon, AT&T and T-Mobile’s towers by the public tower companies, a significant push is on to get the landlords (property owners) under these sites to sign extensions and amendments. One of the main purposes of this effort is to include Rights of First Refusal and other clauses in the amendment that can and will reduce the value of your lease if monetization is an objective. See the Recommendations for Sellers in the Lease Buyout section of TCA’s website.

2. More players and fresh money flew into the market in 2023 as alternative commercial property investments with secure revenue streams were reduced by the pandemic. Some were in for a rude awakening as prices soared (but now seemed to have peaked). Over the long run, many will not be able to keep up with competitive prices and sustain large organizations with high overhead. Working with TCA allows you to take the profit that otherwise would have been made by these firms for yourself.

3. Don’t be fooled by ‘buyers’ that are vendors for the tower companies and/or carriers. The services they provide pay them for reducing rents and obtaining Rights of First Refusal and Expanded Use clauses in any amendments. It might also include buying assets with the promise of sharing in ‘above scheduled rent’ only to sell the asset or assign the extensions to the tenant.

4. More and more brokers are entering the market – and it is difficult to tell who is a real buyer and who is only a broker. We do not feel that Sellers should retain brokers that they have to pay in this sector and can, either through direct contact with purchasers or by working through Buyer paid intermediaries, obtain better pricing without doing so. Additionally, TCA does not usually recommend the use of law firms or attorney’s that specialize in the wireless sector, as any good real estate attorney can handle the type of documentation associated with these transactions on a more cost-effective basis. It is also unusual for a law firm to be compensated on a percent of purchase price basis. A Seller should want his attorney to be unbiased with respect to whether a transaction closes or not.

5. Reiteration: Seller Beware: Site Owners that sell for less than they should are sometimes sold on the promise of the buyer bringing additional tenants to their property. Many, if not all, financial aggregation firms offer ‘sharing’ arrangements for future revenue they claim they can bring to your site. In the case of cell towers (vs. rooftops), only the TOWER OWNER has anything to do with soliciting new tenants – so a 3rd party purchaser of your ground lease under a tower cannot do anything to bring more revenue to the property. In the case of both cell tower or rooftop installations, only the strategic firms and the carriers themselves determine where sites are needed, and most, if not all, of the financial aggregators, do nothing about marketing your property. Large cell tower companies offering to buy your rooftop may be conflicted with respect to whether to put the next carrier on your property or on their tower, which would be more profitable. Bottom line: Don’t be fooled by groups that pitch you on how they will bring you more revenue down the road. Few firms actually even try, and if it happens at all, it will be purely up to the carriers that need coverage in your area, not the buyer of your lease.

Get an offer from Tower Capital Advisors today and see how it compares to what you have been offered in the past.

Disclaimer: Information is provided by TCA based on publicly available resources, personal experience in the industry acquiring, holding and selling millions of dollars of these assets since 2001 as well as from frequent conversations with industry players. It is an opinion, albeit experienced, and thus should not be solely relied on in deciding whether or not to sell your asset, how to sell your asset or to whom to sell your asset.